Hey Everyone,

While we know Sam Altman has A.I. chip venture plans, I have more faith in Softbank’s ability to raise funds to be honest.

Softbank has a $41 billion cash pile and finances helped by Arm, of which it owns 90% (89.9% really). Curiously the wealth of this Japanese Billionaire is mostly due to his older bet on Alibaba and Chinese E-commerce.

Curiously thought this is actually a good idea. Codenamed ‘Project Izanagi’ might leverage Arm design. It’s not clear if this is one and the same as Sam Altman’s project or another distinct Venture. We know that at the very least they were talking.

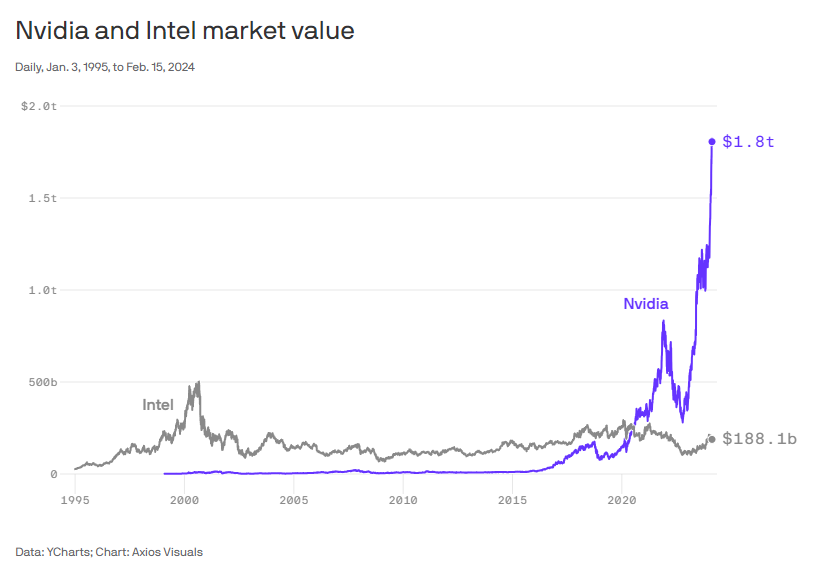

A $100 Billion plan is at least more realistic than a total $5 Trillion plan. Softbank will allegedly set up an AI processor company to complement Arm and if it can pull it off it means that eventually it might be a competitor to Nvidia, AMD and others in the A.I. chip space, in some capacity.

AI chip Supremacy is increasingly becoming a big deal.

This news was first published by Bloomberg on February 16th, 2024.

Shout-out to Dan Nystedt who I consider a reliable source on the semiconductor industry.

Softbank would itself inject $30 billion in the project, with an additional $70 billion potentially coming from Middle Eastern institutions, according to the report.

It’s clear there is a demand shortage for AI chips in the years ahead and there will be an avalanche of money spent to solves this issue to allow Generative AI to reach its full potential as fast as possible. Otherwise a significant AI bubble is going to collapse sooner rather than later as people realize how useless these technologies are still.

Big Ideas in Venture Capital

Venture Capitalists are dreamers at best. Son envisions this initiative as contributing to the development of artificial general intelligence (AGI), leading to a future where machines surpass human intelligence.

Son is apparently a fan of ChatGPT and thinks it has potential.

But how it adds value to ARM really is tangible and also adds value to Nvidia that is itself invested in ARM.

The project seeks to complement SoftBank’s Arm Holdings, which designs processor architectures. Nvidia wanted to acquire ARM for $40 billion in 2020 and thus got financially entangled with it. So Son and Jensen Huang are really in bed together here. Don’t look now, in 2024 ARM’s market cap is $132 Billion. This stock spike made Son very rich again.

It makes more sense for investors to trust Son (who has skin in the game) than Sam Altman, who is a wheeler and dealer and even is the single owner of what is termed OpenAI Venture fund. Sam Altman seems to have used the name of the fame of OpenAI, for his sole benefit and failed to even disclose it.

OpenAI Startup Fund was launched in late 2021 to invest in other AI startups and projects. But nobody knew exactly what it was. Sam Altman isn't just the CEO of ChatGPT maker OpenAI. He's also the owner of OpenAI Startup Fund, which Altman once called a "corporate venture fund," according to federal securities filings. Corporate because Sam is in bed with Satya Nadella, the CEO of Microsoft.

On paper Izanagi has a lot more going for it than Sam Altman (who knows zero about the semiconductor industry, or let’s face it even how AI works), and Son has a lot more experience and likely trust of Saudi Arabia. Sam seems to be targeting the UAE. Though it would take years for their efforts to amount to anything, for the Machine Economy this is potentially big news.

Keep reading with a 7-day free trial

Subscribe to Machine Economy Press to keep reading this post and get 7 days of free access to the full post archives.