The 'Great Trimming' for Tech Startups Has Begun

The Good Times are over for high-growth Startups

Hey Guys,

Lately I find myself pretty obsessed over the startups layoffs we are witnessing in the second half of May, 2022. I actually think it will accelerate pretty badly into June and the summer of 2022. I call it the “Great Trimming”.

Startup Layoffs will be Rather Epic

So what does the Great Trimming entail? I liked how the Quest Digest recently summarized this. This is one of the Newsletters I recommend for good weekly round-ups of Silicon Valley News.

What the Quest Digest Said about the Great Trimming

As Sequoia has done in the past during times of turbulence (R.I.P. The Good Times in 2008, and Black Swan in 2020), the venture firm has released another long-form memo to portfolio and partner companies.

Here is how the writer behind the Quest Digest summarized the memo here.

Here are our biggest takeaways:

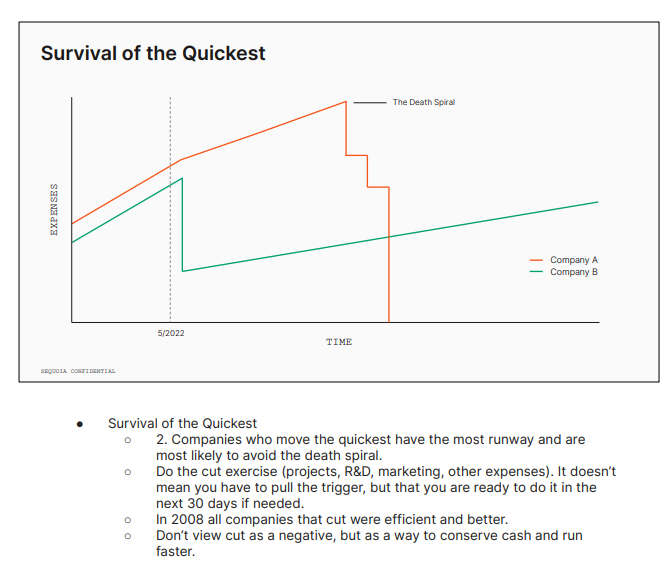

Those that survive will be the ones that move the quickest and have the most runway

Don’t view cuts as a negative, but as a way to conserve cash and run faster

Ask what you would do if you have just 6 months of cash left. What would you focus on? Get that focus now regardless of how much is in the bank

Talent is ripe for the picking. All the FAANGs have frozen hiring

Courage is a decision, so choose courage and confront reality. Whatever we are facing today, it can’t be worse than the uncertainty at the start of the pandemic

Start with why, reaffirm the mission, and showcase your leadership. Ask for your team’s commitment… or politely ask them to lighten the boat

Track sales, metrics, and cash daily. What gets measured gets managed.

Create financial degrees of freedom: Earn more from users, improve your unit economics, cut excess, if necessary raise debt or equity

Managing change is everyone’s job. As a leader: It’s your personal assignment

The best, most ambitious, and most determined will use this moment to rise to the occasion and build something remarkable – there is opportunity ahead.

Overview of the Great Trimming in Startups

In American Tech, it’s 15k jobs in May alone. I’d estimate around 80% of these were at high-growth startups. But it’s just the beginning. ChinaTech and now Indian startups have seen the same thing, huge layoffs and hiring freezes. Sort of ordinary for the run-up to a global recession, eventually the housing bubble crashes as well.

Sequoia Capital and Y Combinator have told startups that cutting costs is a priority. Other Startup incubators and VCs are saying the same thing, adapt or die. The Great trimming is about startups adapting or dying and for emerging fields like Web3 and NFT hype, it’s going to be a pretty epic downfall to witness.

I summarize it all here.

According to Inc42, in Indian startups so far, 8,364 employees have been laid off by 13 startups, which includes unicorns such as Vedantu, Cars24, Ola, Meesho and Unacademy. Clearly TechCrunch does not tell the entire story. The job cuts in Chinese tech and startups has been even more brutal for the last few months.

Back in early 2020, an online layoff tracker — Layoffs.FYI — was built to collect and tabulate startup layoffs. The Great Trimming in the West started in May, 2022, but it could go on for months as a new paradigm unfolds in how VC, startups and growth in smaller companies occurs. The era of free money is over.

Venture capital firms such as Sequoia Capital and Y Combinator are sounding the alarm for startup companies that the days of raising capital easily are over.

The well-known VC sent 250 founders a 52-slide presentation via Zoom on May 16, alerting them to a “crucible moment” as higher rates of inflation, volatility in the stock market and several geopolitical issues led to less certainty in the venture capital market.

You can see the presentation here.

From Bubbles to the Great Trimming

Startups and their backing investors realized shortly after cuts swept the industry that most upstart tech companies were going to be at least all right during the pandemic, slowing the rate of layoffs. But there was always going to be a day of reckoning. All those bubbles would have to come crashing down one day for tech startups. Software companies wound up enjoying record demand, from both customers and investors, eventually fueling the 2021 SaaS bubble.

Just like in Natural Selection, not all startups are created equally. It doesn’t always matter how much money you funded or how smart your leadership is, it matters how well you adapt, pivot and conserve for the future.

While I’m interested in the individual stories of trimming at companies and startups, I’m also a macro guy, I’m interested in how this all unfolds. With higher interest rates, access to liquidity and cash will be much harder for startups post 2022.

No Quick Bounce Back in the Great Trimming

Sequoia told the startup founders that there likely will not be a “swift V-shaped recovery like we saw at the outset of the pandemic,” and instead recommended that they evaluate their companies for costs that could be slashed.

With all these bubbles we are so used to buy the dip mentality and a V-shaped recovery during the pandemic, but with a recession looming, it could take many months or years to get back to normal and the new normal for startups might be building companies on hard mode.

A behemoth in the venture capital world, Sequoia, founded in 1972, sort of knows what it’s talking about.

Avoiding the Death Spiral

So the startups that make the cuts and right actions fast, can avoid the most long-term pain. Funding will be harder to come by so your entire strategy needs to be adjusted.

For many tech startups, it’s not about winning in a recession, it’s literally about surviving.

In just the last five days, you will notice a lot of Series B stage startups are realizing they have to do drastic things to avoid the death spiral. (Source). In late May a lot of them are also in finance.

But how much can it accelerate? The Great Trimming for startups will ravage the globe and even mean major companies will have to do serious layoffs and not just hiring freezes to get back into balance. Think of all the companies that over hired when the going was good. (like Amazon).

For anyone working in tech knowing that your company could face a death spiral is daunting, but we have to face reality as it comes.

You will know the Great Trimming has arrived, when it really hits the U.S. and not just “other” countries.

For leadership and startup employees, it’s a huge pivot in the Great Trimming. Surviving a death spiral means acting fast and smart.

A number of tech companies that enjoyed pandemic-related surges are facing a correction and this Great Trimming will last years because interest rates, inflation and supply-chain and oil prices could last months and years. Labor supply-demand constraints will mean the war for talent is also higher during a Great Resignation that isn’t temporary. It’s all connected. Access to Capital will be reduced for a pro-longed period.

The Great Trimming Ushers in a New Paradigm

For startups, it’s not the time to gamble but to utilize the crisis as a springboard.

Anyways guys I’m out of space, but that in a nutshell is what I see happening. The Great Trimming is real and will have lasting consequences on the future of technology.

Thanks for reading!